Santa Cruz Housing Market: Hot, Hot, Hot!

By Seb Frey

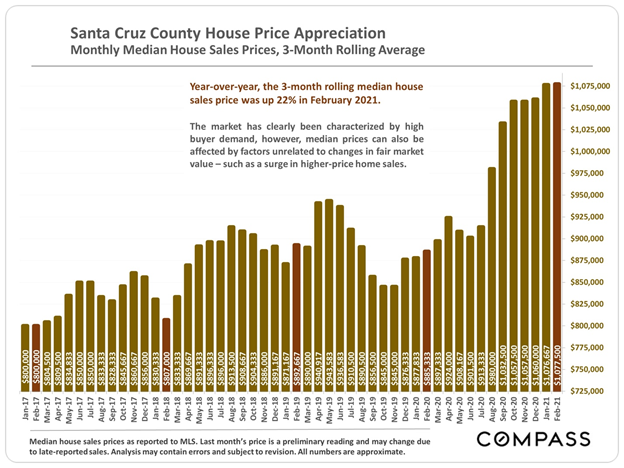

It’s no secret that right now the real estate market in Santa Cruz is hot. Actually, you could say it’s overheated! There’s no shortage of stories of homes receiving dozens of offers and selling hundreds of thousands of dollars over asking price.

It’s no secret that right now the real estate market in Santa Cruz is hot. Actually, you could say it’s overheated! There’s no shortage of stories of homes receiving dozens of offers and selling hundreds of thousands of dollars over asking price.

But in a way, that’s yesterday’s news. The thing to know about the real estate market is that it’s dynamic. What’s true yesterday may not be true today, or what’s true today may not apply tomorrow.

For example, interest rates have risen substantially over the past several weeks – up about 0.75% give or take. That might not sound like much but considering that the best rates a couple months ago were 2.5%, 0.75% is a big jump. Today, 30-year fixed mortgage rates are bumping up around 3.3%.

That kind of jump up will definitely have an impact in terms of affordability – buyers won’t have the same borrowing power relative to their income. Many people are expecting that this increase in mortgage rates will therefore result in a decline in real estate prices.

It’s easy to see why people think that – except that there have been many periods in history where interest rates rose – and home prices rose, right along with them. The reason for this is that interest rates rise as demand for money rises (or at least, the projected demand for money). Demand for money rises when economic activity picks up. Stronger economic activity points to job and wage growth – which means there will be more buyers out looking for property, which will boost prices, even as rates rise.

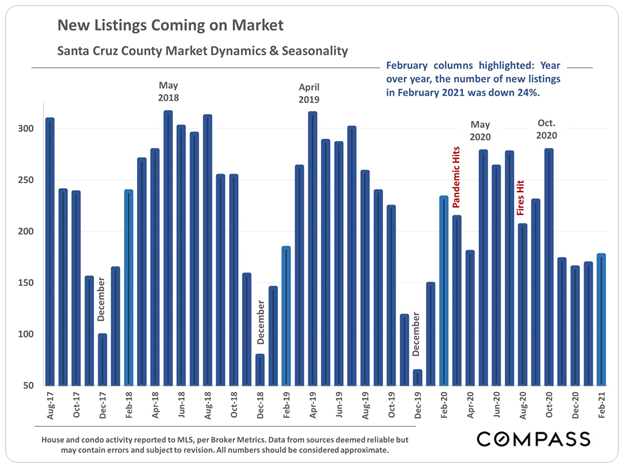

If you’re looking to see moderation in home prices, you’d do better to keep an eye on inventory. For years now, we’ve been suffering through a dearth of homes for sale. Too many buyers chasing too few homes has resulted in steady prices increases for the past 10 years or so.

A couple of years ago I interviewed Leslie Appleton-Young, then Chief Economist for the California Association of REALTORS. I asked her what number she looks at most when she’s forecasting what’s going to happen to home prices, and she replied with one word: Inventory.

Springtime is when we traditionally see more inventory coming onto the market – a lot more. However, demand has been so strong that we haven’t seen much of a build-up in inventory. In most neighborhoods, and most price segments, homes are selling about as fast as they hit the market.

Yet might demand weaken, just as more homes are coming on the market? Might the jump in mortgage interest rates and buyer fatigue with the bidding wars ultimately conspire to tamp down demand? Will inventory start to build and prices flatten, pushing the market to something closer to a state of balance?

Eventually – one day! – that will happen. But there’s no telling when. Might the $1.9 trillion in COVID relief and stimulus slingshot the market to ever higher heights? Could the Biden administration and their oh-so-slim majority in congress actually manage to squeak out a $3 trillion infrastructure (or whatever they’re calling it) plan, virtually assuring robust economic growth for at least the next couple of years?

It’s quite possible! That could happen – the stock and bond markets are apparently betting big on just that eventuality. Hence the rising asset prices and climbing interest rates.

What are buyers to do in a market like this?

If you ask me, it requires two things. First is a leap of faith. To get into a house in today’s market, you have to be fearless. You have to stop worrying if the bubble is going to pop. In other words, you have to be present. You have to focus, relentlessly, on the here and now.

The other thing you need to do is to take action – here, and now. If you see a future for yourself as a homeowner, you need to take the steps today that will put you in a position to be a homeowner tomorrow. That means calling a mortgage broker and getting pre-approved. That means taking a hard look at your expenses and seeing what can be cut. That means looking at how you can increase your income, through promotion, a change in career, whatever.

It may also mean looking at how you can increase your down payment – possibly with help from family, selling some assets, or tapping into retirement savings. It may also require that you lower the bar – instead of a single-family home, you may need to look into a condo, townhouse, or possibly a mobile home. You may need to widen your geography and consider areas outside the neighborhoods hugging the coast.

The road to homeownership isn’t for the faint of heart – not in this town, and increasingly not anywhere in California…or any of the economically successful region of the United States, for that matter.

But there’s no question that the ends justify the means! There’s a word that’s become very popular in the past couple of months in American politics: equity. Equity! Everyone needs it, and the tried and true way to build it is through homeownership. I hope you will soon be on the road to obtaining your fair share as well.

Realtor Seb Frey is the author of the book Get It Sold! Check out his videos on Facebook and YouTube – search for “Seb Frey TV.” Learn more on his website and reach him at [email protected]

You May Also Like

Maria Cadenas Focuses on Love

March 29, 2021

Santa Cruz Seeds

March 29, 2021