What to Know About Buying a Home in Santa Cruz

by Seb Frey

One of the most popular pieces I’ve written in 17+ years selling real estate in Santa Cruz county is one where I take buyers through the whole process of buying a house in Santa Cruz, from start to finish. But with prices surging to astronomical heights, this real estate market feels so much different than anything I’ve seen before. But what, exactly, is so different about today’s Santa Cruz real estate market?

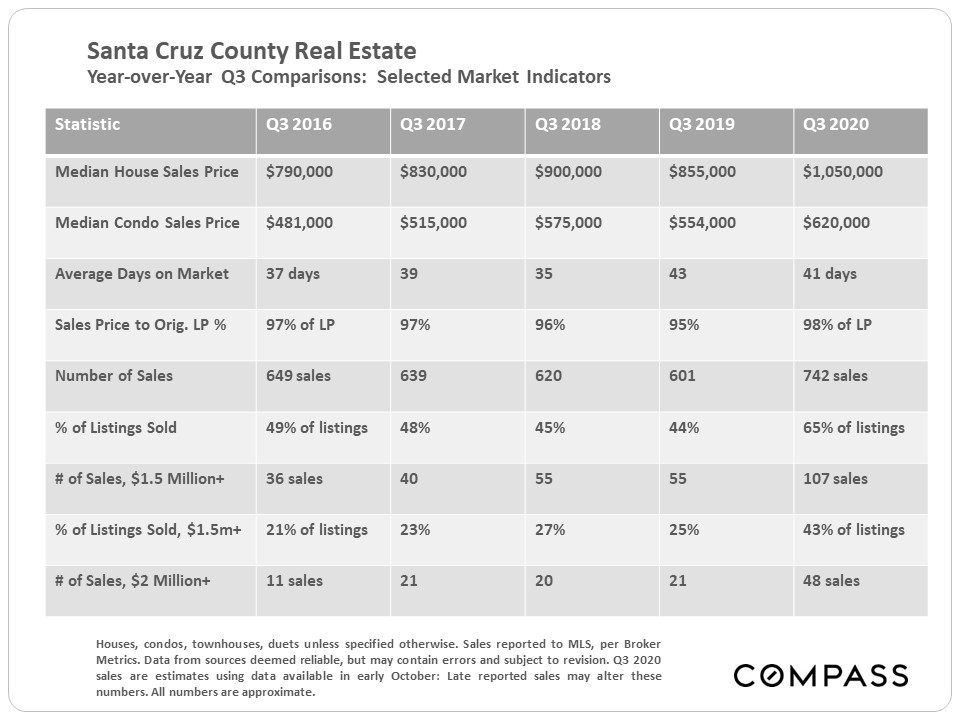

To get a perspective, the median sale price for single family homes in the third quarter of 2020 was $1,050,000 – that compares with a median Q3 sale price in 2019 of $855,000 and $900K in Q3 2018. These pricing levels are obviously putting the hurt on the vast majority of would-be homebuyers. With 20 percent down on a $1,050,000 sale price, you’d be paying on a $840,000 mortgage, requiring a household income in the neighborhood of $168,000 per year (pre-tax, assuming you have minimal-to-no other debt payments).

The median price, though, can be a misleading figure. That’s because different houses sell in different months and years. Recently, we’ve seen a greater number of larger homes on larger lots selling. We can thank out-of-town Silicon Valley buyers for that. These buyers are looking for more spacious homes they can live in and work from, with a generous amount of outdoor space.

If you want proof, take a look at today’s market (Q3 2020) versus the two years which preceded it.

Q3 2020

581 homes sold

Avg. lot size 74,730sf

Avg. home size: 1,892sf

Avg. $/sf: 673

Days on Market: 27

Listed Homes: 556

Q3 2019

487 homes sold

Avg. lot size: 55,603sf

Avg. home size: 1,789sf

Avg. $/sf: 593

Days on Market: 39

Listed Homes: 652

Q3 2018

509 homes sold

Avg. lot size: 52,191sf

Avg. home size: 1,786sf

Avg $/sf: 604

Days on Market: 34

Listed Homes: 706

As you can see, homes sold in the third quarter of this year tended to have been on larger, more expensive lots (nearly 30 percent larger), and the homes themselves are nearly 6 percent larger. The price-per-square-foot is up about 15 percent compared to the previous two years, but much of that is because the price per square foot does not account for the additional value of the 30 percent larger lots.

Another characteristic of today’s real estate market is that homes are selling about 26 percent faster this year than in the previous two years. This is explained to some degree by the fact that about 12 percent fewer homes were listed for sale in Q3 2020 as compared with Q3 in the previous two years, while the number of homes sold was about 15 percent higher this year. Fewer homes for sale plus more homes selling = a wonderful experience for a home seller, but something akin to misery for buyers.

If you’re actively trying to buy a home right now, let me assure you: you’re not imagining it. There are few homes for sale, and homes are selling very quickly. In fact, in Q3 2020, more homes were sold than were listed in the quarter, in a marked departure from the two years prior.

But in terms of pricing and affordability?

If you’re not looking for a monster home on a monster lot, you’ll probably find that prices aren’t up nearly so much as the median price would indicate. And don’t forget that one thing driving these prices is cheap money. The 30-year fixed mortgage is averaging about 2.5 percent at the time of writing – but in October 2019 that same mortgage averaged 3.69 percent. That means that $500,000 worth of mortgage today costs $1,975 a month – but a year ago, that same money cost you $2,299. In other words, you can borrow $580,000 today for roughly the same monthly cost as $500,000 a year ago.

But in the coastal flat lands, even a small home is still likely to run north of $800,000. For a house that price, you’d need $160,000 cash (plus another $15K or so for closing costs) to have 20 percent down – and who has that kind of liquidity? Obviously, few first-time home buyers will have that saved up, what with the ridiculous cost of rent.

I’m going to let you in on a couple of secrets here:

First, many first-time home buyers get gifted cash from family. Many others take a tax hit and liquidate a portion of an IRA or 401K – but little of it is coming from money folks have just saved up from their day job wages.

The other “secret” is that many buyers – most, probably – will simply come in with less than 20 percent down. It’s not uncommon for a first-time homebuyer to have only 5-10 percent down for their first home. You might think you’d have a hard time getting an offer accepted with a smaller down payment, but what matters more to most sellers is the offer price, not a buyer’s down payment.

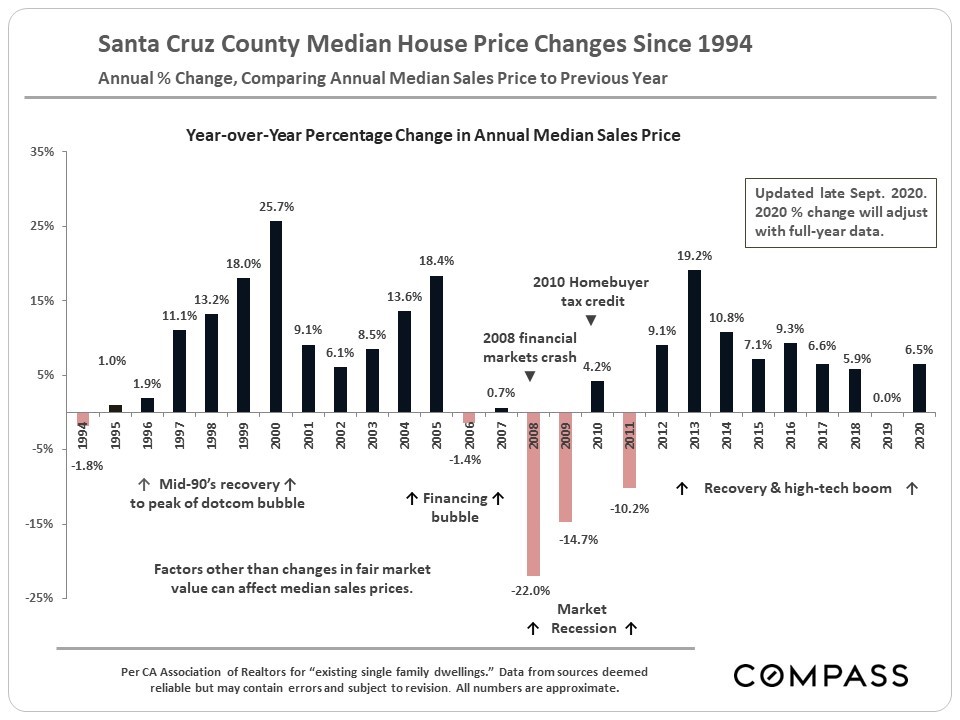

Yes, it’s a challenge to buy a home in Santa Cruz, especially in this market. But having been a part of many home-buying journeys with my clients over the past 17 years, I can’t think of when it’s ever been easy. But if Santa Cruz is where you want to be for the long term, it’s going to cost you a lot more to be a renter over time than to be a homeowner.

Next month, I’ll share some more tips and insights into buying a home in Santa Cruz which may help you make the jump from renter to owner!

Realtor Seb Frey is the author of the book Get It Sold! Besides selling houses, he gives seminars on important issues for homeowners and does a podcast, and has TV Channels, on Instagram and Facebook. Learn more on his website and reach him at [email protected]