Child Tax Credit Brings Benefits

And Potential Pitfalls

By Suki Wessling

The American Rescue Plan Act of 2021, whhich was signed into law on March 20, enhances the 2021 child tax credit (CTC). Most families are automatically receiving monthly payments of $250 or $300 per child without having to take any action. This is great news for families, no matter how you cut it. But it adds some complexity over the existing child tax credit, tax experts say. Read on to learn what the new credit is and how it will affect your taxes.

What is this new CTC and how is it different from the old one?

The major difference is the one everyone is focusing on: More money, more directly! For eligible families, some of the credit is being prepaid directly into families’ accounts. The old CTC was only applied at tax time on your return. And eligible families will see an increase in payments per child.

“For 2021, The child tax credit was increased from $2,000 to $3,600 for children under 6 and to $3,000 for children 6 to 17,” explains Vanessa Platt, a CPA with Chiorini, Platt & Jacobs, Certified Public Accountants in Santa Cruz.

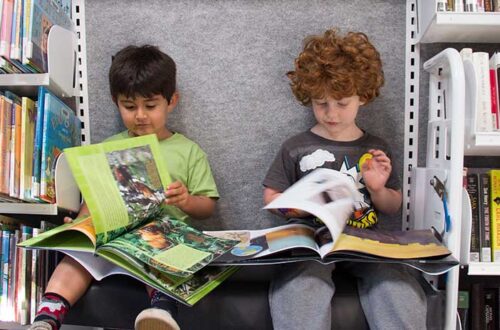

For many families who are having trouble making rent payments or increasing their work back to pre-pandemic hours because of childcare expenses, this increase will help tremendously.

What should low-income families know?

If your family was able to take the CTC by filing 2019 or 2020 returns but has lost your income source since then, you should still be getting the direct payments.

Families who did not file taxes in those years are eligible for the payments; however, they will need to sign up on the IRS website’s “non-filer sign-up.” (See link below.)

According to the IRS, “These payments do not count as income for any family. So, signing up won’t affect your eligibility for other federal benefits like SNAP and WIC.”

Why is my family not getting payments?

The most likely reason is that you make too much money. Although living in expensive Santa Cruz may not make you feel so wealthy, the feds put a cap on who gets the CTC.

“Joint filers with modified adjusted gross income (AGI) between $150,000 and $400,000 ($75,000 and $200,000 for single filers) will get a $2,000 credit per child,” Ms. Platt says. “For joint filers over $400,000 ($200,000 for single filers), the current phaseout rules apply.”

Check your 2020 returns to see if you filed with an AGI over $400,000.

Another possibility is that you didn’t file to receive the CTC in previous years, in which case you will have to sign up on the IRS website’s “non-filer sign-up.” (See link below.)

Finally, there could simply be a mistake, in which case (big sigh) you will have to get on the line with your friendly IRS agent to work it out.

Could there be a downside to getting more money?

“It is important to note that the advance credit received will reduce the CTC credit claimed on their tax return,” Ms. Platt says. That means that if you’re used to getting a lot of money taken off your taxes in April, you will actually see less money being taken off at that time (though you got more money in the end).

Another issue is if you happen to be making more money this year than in previous years. In that case, Ms. Platt explains, “they may be in for a surprise at tax time as they may have received more in advance child tax credit than they were eligible for. They may have to repay a portion of the excess amount through an increase in tax liability on their 2021 tax return.”

Finally, the last downside is that unless President Biden can get this change locked in with his proposed American Families Plan, this will be a one-time increase in benefits. Without action by Congress, the CTC is set to revert to pre-2021 levels in 2022.

But for now, enjoy having a bit more cash for childcare or other expenses.

For more information, visit www.whitehouse.gov/child-tax-credit.